With third-party identity signals in flux, on-site experiences—especially prequalification flows—are now a primary performance lever. Clear “soft-pull” messaging, intentional micro-friction, and trust signals can raise conversion while aligning risk and compliance.

Why UX Is the New Performance Channel for Finance

Marketers can’t count on off-site identifiers to do all the lifting anymore. The dependable growth now comes from durable, owned journeys—your product pages, your forms, your prequalification (prequal) flow. For financial brands, that’s good news: unlike rented media, prequal UX is yours to tune. Small decisions in microcopy, sequence, and disclosure move users from curiosity to confidence.

“Good Friction” vs. “Bad Friction”

- Good friction: a plain-English explainer of what a “soft credit check” is; a progress meter; realistic time expectations (“~60 seconds”); a results screen that spells out next steps and when a hard pull happens.

- Bad friction: redundant fields, surprise document asks, vague error states, or disclosures buried in footers.

The job isn’t to remove every bump—it’s to add the right amount of clarity. Done well, good friction reduces abandonment and screens fraud without kneecapping CVR.

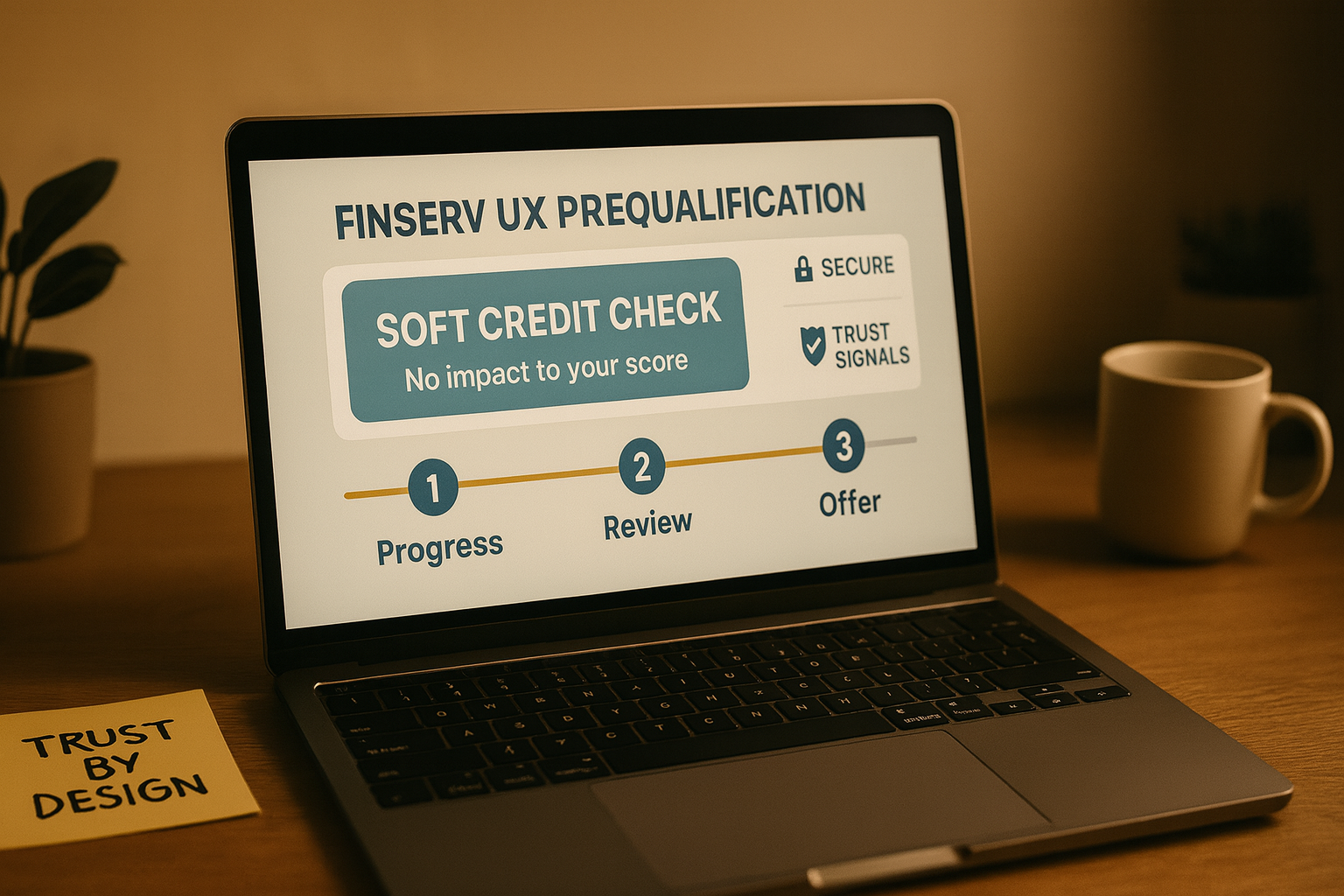

The Anatomy of a High-Converting Prequal Flow

Above the fold

- One crisp value prop and a primary “Start prequalification” CTA.

- Soft-pull clarifier: “Check eligibility with no impact to your credit score.” This line is a confidence trigger when the check is a soft inquiry.

Step 1 — Basics

- Minimal PII (name, address, DOB, last 4 SSN if policy requires).

- Inline validation and mobile-friendly keypads.

- Accessibility baked in (labels, focus order, readable defaults).

Step 2 — Eligibility Check

- Human copy: “We’re running a soft credit check. This won’t affect your score.”

- Micro-loader with expectation setting (a few seconds feels faster when explained).

- Fraud screening runs silently (velocity, device fingerprint, bot filtering).

Step 3 — Results & Next Steps

- Clear outcome (“You’re eligible” / “You may qualify after X changes”).

- Only now introduce any hard pull language if the user opts to continue to a full application; explain the difference plainly.

Trust pattern

- Recognizable network/issuer marks, security cues used sparingly, concise legal copy that’s readable on mobile.

Explain “Soft Pull” in Plain English

A soft inquiry (soft pull) reviews elements of a consumer’s credit file and does not affect credit scores; it’s distinct from the hard inquiry that can accompany a full application. Keep your copy direct and calm. Many credit-builder products now let you check eligibility with no impact to your credit score — for a live example of this phrasing, see: directcard.com/

Microcopy & Design Details That Move the Needle

- Soft-pull line (above the fold): “Check eligibility with no impact to your credit score.” Pair with a short “How it works” tooltip.

- Time expectations: Promise only what you can meet (“About 60 seconds”).

- Buttons: One primary action per screen; predictable placement.

- Errors: Descriptive, inline, anchored to the field (never generic banners).

- Progress: A simple three-step indicator (“Basics → Check → Results”).

Risk & Compliance Choreography (Without Killing CVR)

- KYC sequence: Ask the minimum to evaluate eligibility; defer heavier KYC to after an “Eligible” result when motivation is higher.

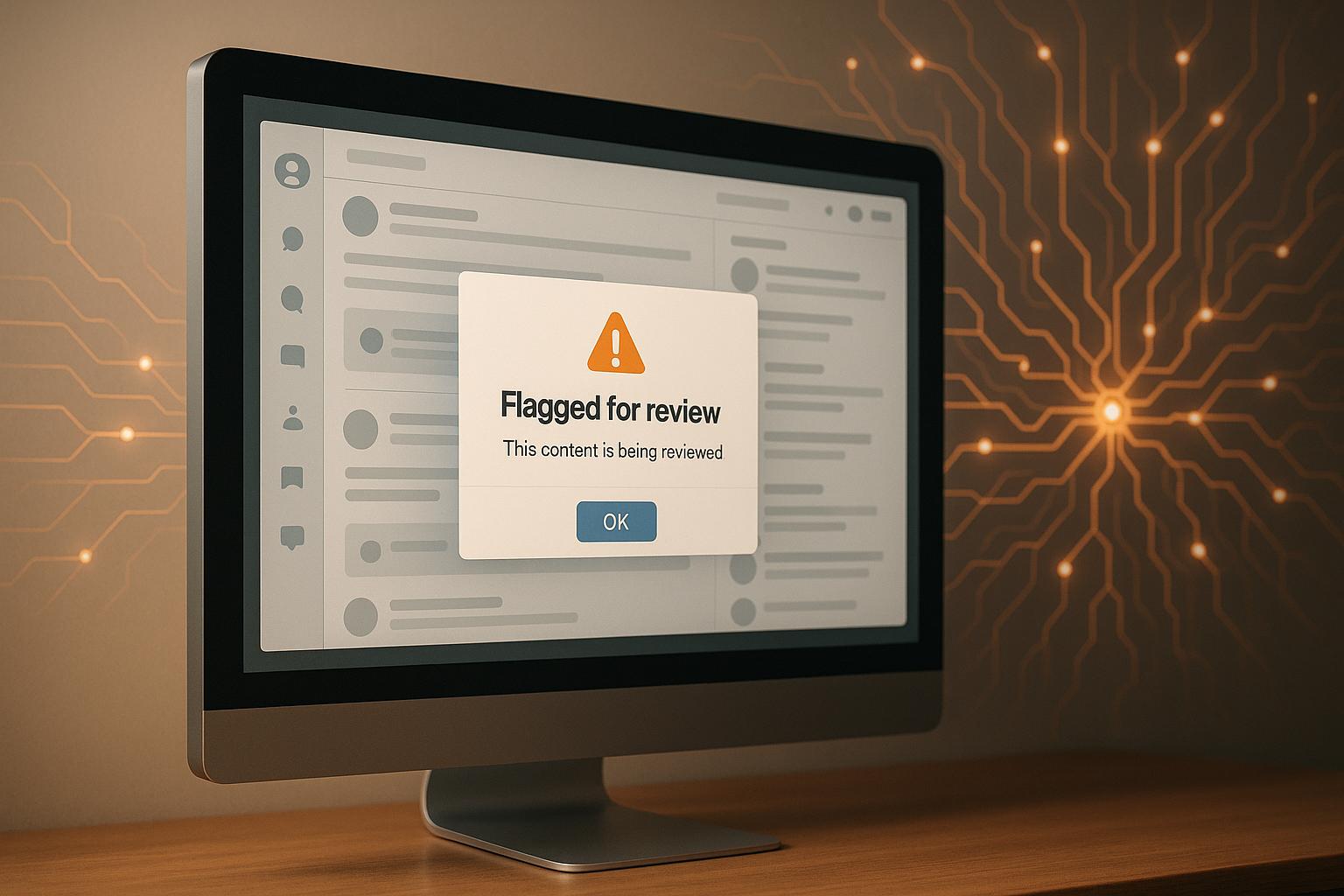

- Silent controls: Keep bot detection, device checks, and velocity limits out of the user’s way; if friction appears (e.g., CAPTCHA), add a sentence that explains why.

- Disclosure hygiene: Ensure APR ranges, fees, and issuer/legal copy are legible and proximate to the CTA where required—not hidden.

- Expectation setting: If continuing will trigger a hard inquiry, say so on the results screen and link to a short explainer.

Measurement That Finance CMOs Believe

Instrument the full funnel, not just starts:

- Started prequal

- Soft-pull success

- Eligible

- Application submitted (hard pull)

- Approved

- Activated/Funded

Prioritize safe, interpretable tests: microcopy placement, when to ask for SSN last four, and geo holdouts to observe downstream approvals independent of platform modeling.

Accessibility & Inclusion (Often Missed, Always Expensive to Fix)

- Minimum 16px body type, sufficient contrast, and clear focus states.

- Use labels (not placeholders) for every field; don’t rely on color alone.

- Group related fields (address, date) to reduce cognitive load.

- Write in everyday language; it helps everyone, including users rebuilding credit or using assistive tech.

Real-World Language Examples (Non-Endorsement)

- “See if you’re pre-approved without harming your credit score.”

- “Pre-approval involves a soft inquiry.”

- “We’ll only do a hard pull if you choose to apply.”

Closing Thought

The most defensible growth lever is the experience you fully control. Treat prequalification UX like a product: explain the soft pull, earn trust with small, intentional friction, and measure what actually matters—approved, activated customers.

![Top 7 Best Instagram Growth Services in 2025 [RESULTS]](/cdn-cgi/image/fit=contain,format=auto,width=null/https://cdn.prod.website-files.com/67840d1d88a886f29a66a4c1/6795d12917ee4501b9eddf73_6795c731964f791db3b566c4-1737870861582.jpg)

![UpGrow Review – The Best Instagram Growth Service in 2025 [TESTED]](/cdn-cgi/image/fit=contain,format=auto,width=null/https://cdn.prod.website-files.com/67840d1d88a886f29a66a4c1/6795040db42e404207732526_6794fd9c964f791db3b48de9-1737818779111.jpg)